estate and gift tax exemption sunset

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Ad Help You to Probate Estate.

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

. Here are the programs that can. What happens to estate tax exemption in 2026. You can gift up to the exemption amount during life or at death or some combination thereof.

These taxes only apply to that portion of the estate on gift value that exceeds the exemption level. Without planning your best intents to properly distribute your estate might not be enough. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the.

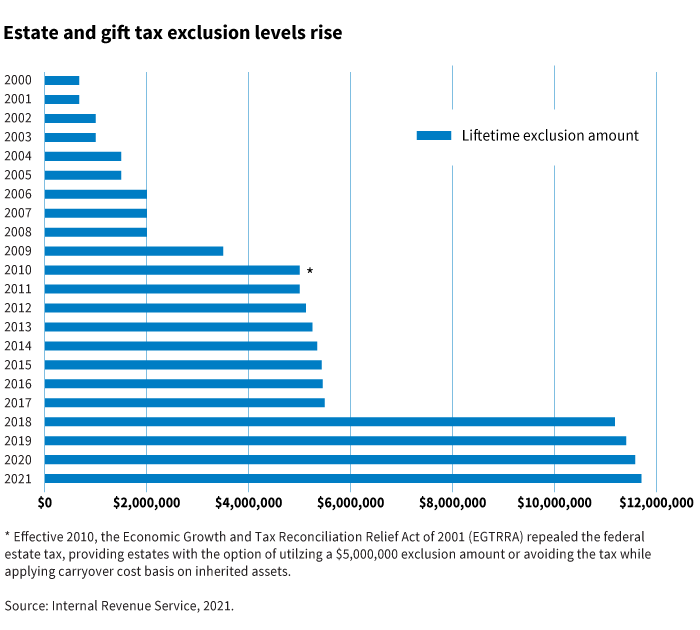

Under current law the estate and gift tax exemption is 117 million per person. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. Fast-forward to 2026 and the estate and gift tax exemption.

For instance a married. Calculations of sunrise and sunset in Piscataway 08854 USA for October 2022. Get Legal Help Getting Through Probate.

Generic astronomy calculator to calculate times for sunrise sunset moonrise moonset for many cities. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted. The current estate tax and gift tax exemption.

The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills.

The answer is more complicated for New Jerseys estate tax. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted.

Legal Service Since 1999. New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. We are currently mailing ANCHOR benefit information mailers to.

For individual taxpayers almost all provisions sunset at the end of 2025 while most business provisions are permanent. A provision of the Tax Cuts and Jobs Act of 2017 more than doubled the. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think.

A 987 Client Satisfaction Rating. Any tax due is. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married.

This gives most families plenty of estate planning leeway. Fast-forward to 2026 and the estate and gift tax exemption. Ad Properly drafted estate plan does more than merely specifying what happens to your assets.

Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year 2017 and its. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed. Understand the different types of trusts and what that means for your investments.

Three Estate Planning Strategies For 2021 Putnam Investments

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

The Generation Skipping Transfer Tax A Quick Guide

High Net Worth Families Should Review Their Estate Plans Pre Election

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Summer Legislative Updates And Looking Ahead To Sunsets The Community Foundation

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Gift Money Now Before Estate Tax Laws Sunset In 2025 The Wealthadvisor

Jd Supra Wealth Transfer Tax Planning Implications Of The 2017 Tax Act

The Winds Of Change Are Blowin Pallas Capital Advisors

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Gift Tax Returns Must Be Filed Or Extended By 4 15 20 Weaver

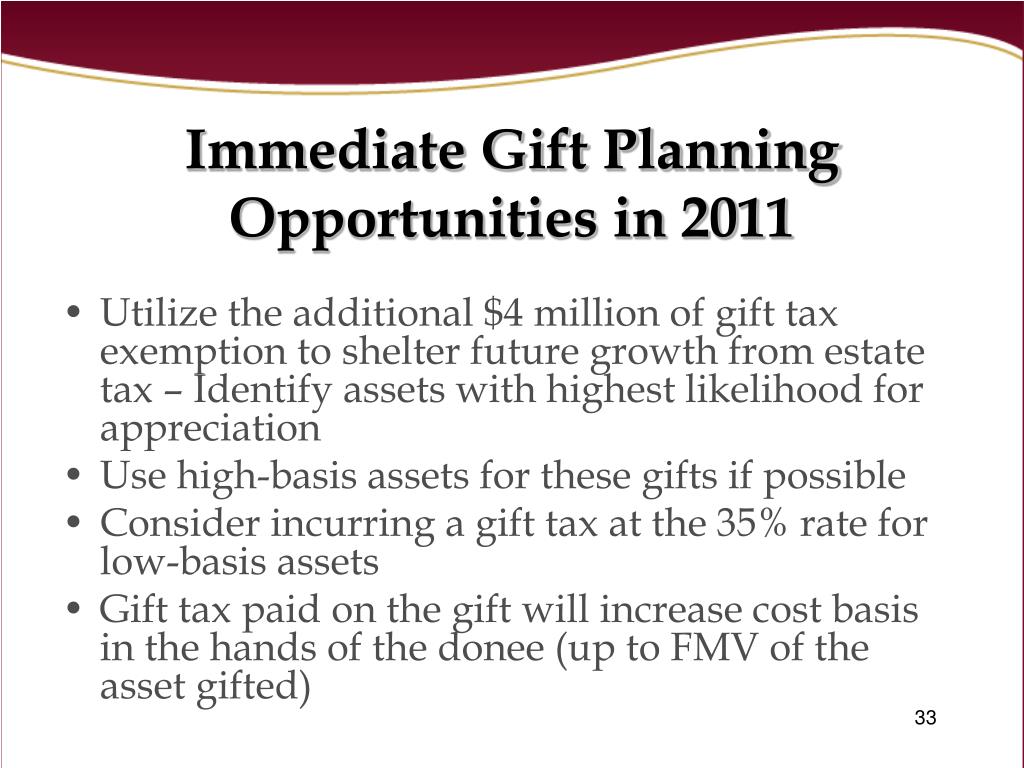

Ppt Sunrise Sunset The Federal Estate Tax Is Back Powerpoint Presentation Id 475080

The Federal Gift And Estate Taxes Ppt Download

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Estate Tax Exemptions Trust And Estate Planning Armanino

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis